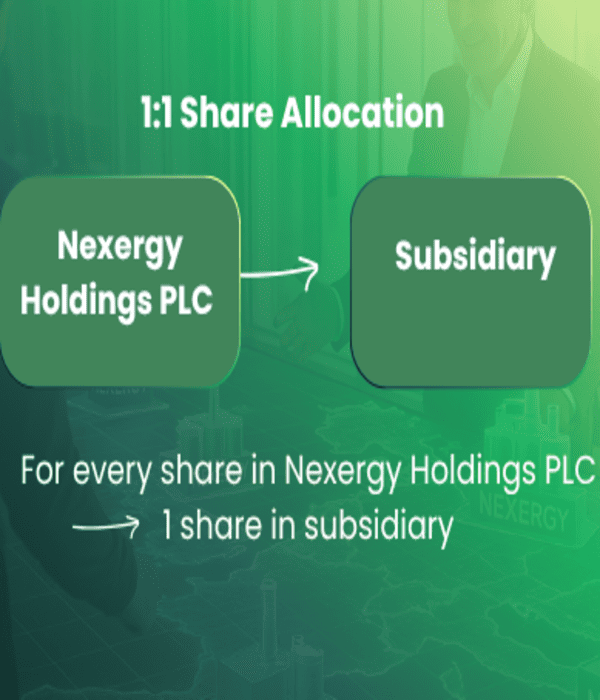

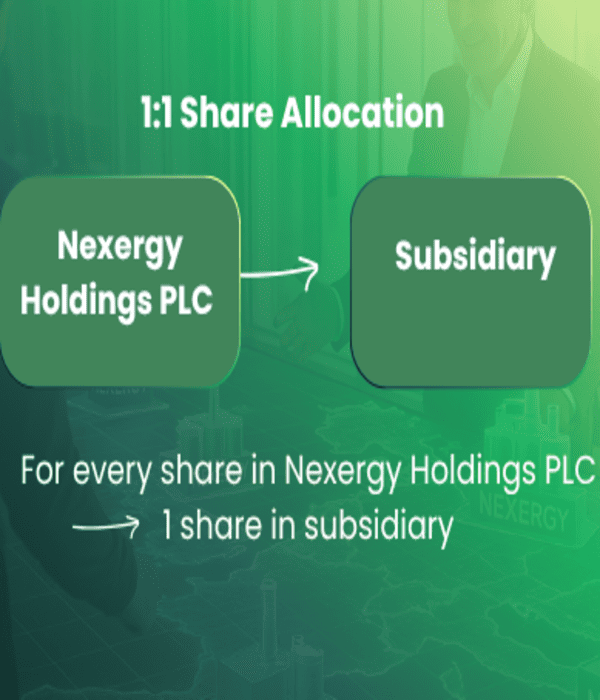

Shareholder Announcement 1:1 Allocation of Shares in a Nexergy Group Subsidiary Issuance Date: 23 December 2025

United Kingdom – Nexergy Holdings PLC announces an important development within the Company’s ongoing organisational strategy.

United Kingdom – Nexergy Holdings PLC announces an important development within the Company’s ongoing organisational strategy.

Senior representatives from Nexergy Holdings PLC, Enespa AG and Stopford Limited met in London to finalise the next stages of their strategic collaboration.

Nexergy Holdings PLC (“Nexergy”) today announces a major step forward in its mission to transform the UK’s waste-to-value landscape through a strategic collaboration with Enespa

Disclaimer

The information provided by Nexergy Holdings PLC (“we”, “us”, or “our”) on our website, https://nexergyholding.com is for general informational purposes only. While we strive to keep the information accurate and up-to-date, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, or suitability of this information for any purpose. Any reliance you place on such information is therefore strictly at your own risk. Our website may contain links to third-party websites. These links are provided for convenience only and do not imply endorsement. We have no control over the content or availability of those sites and are not responsible for any information contained therein.

Get our monthly newsletter

13 Responses

When do you expect to list on the stock market?

Hi!

For more details regarding our stock market listing, please reach out to our investor relations department at ir@ellenora-pads.com.

What is the minimum. Can invest and how is it converted into shares which shall be allocated to the investor

How long this process takes

Is this FCA pr,otected investment

Does this one under tax saving investment

Thank you Kanti for your interest in Nexergy. For details on the minimum investment, share allocation process, FCA protection, and tax benefits, please contact our Investor Relations team at ir@ellenora-pads.com. They will provide all the necessary information promptly.

Good evening,

i’m possibly looking to invest just completing some due diligence

i cant see any privacy statement on your site could you supply

Also what are your projections on the value of your company given that you set out with an instant £1.30- £1.80 per share after flotation at 0.92

regards

Thank you for your interest in Nexergy. We are currently in the process of updating our website to include our privacy statement. Regarding our projections, after initial flotation at £0.92, our strategic investments and growth initiatives aim to increase our share value to between £1.30 and £1.80. We are confident in our business model and the sustainable energy solutions we invest in, which support these projections.

I am interested in investing

Hi John!

To explore investment opportunities, please contact us at ir@ellenora-pads.com or complete the form on our website. Our advisors will reach out to you shortly.

Thank you for your heartfelt words. You deserve to do well as an eco-friendly PLC.

Most impressive business plan with a tremendous future for the world investor

Jacques Paquet

jac.paquet@sympatico.ca

Best regards.

Wow amazing!

Thank you Matthew!